Financial obligation is merely you to definitely. How well you pay they right back can help their pre-acceptance

Central Palms Hotel- A mortgage is probably the greatest financial commitment you will have, that it probably takes more substantial part of your month-to-month money. But because it’s already dispersed more age, it could grounds less than holding higher balance in other obligations items (including credit cards).

- Holding several mortgage is achievable if you possess the money or equity to help you qualify (including, for those who have an investment property or 2nd mortgage).

Instalment Personal debt

Safeguarded. Monthly-fee count. An auto mortgage is a good example of it obligations-variety of. The fresh fixed costs (generally in for 1 – 8 many years) can be simpler to budget up to than rotating borrowing from the bank (where monthly my company fees is climb up into the a brief period of energy). Loan providers will determine the debt-service ratios using your repaired percentage numbers in lieu of factoring in the the entire loan balance.

- Instalment loans constantly grab less time to repay as compared to home loan personal debt, however, these include however a long-term connection (think monthly cash flow!).

- When including this type of obligations, ensure it is enough room for other expenditures or financial obligation that may started together.

- Given that instalment obligations costs are an equivalent monthly, they can be better to would (than the revolving borrowing from the bank).

HELOC Personal debt

Rotating, Covered. Entire balance. Distinct from a personal line of credit (LOC), that’s unsecured and usually carries a top interest rate – people have fun with property Collateral Line of credit (HELOC) so you can consolidate higher-focus personal debt, and for large expenditures, particularly home renovations. These loans try determined out such as a home loan, rather than a share of your equilibrium.

- Good HELOC try safeguarded by your home or property and you will, thus, is far more flexible much less adjusted for your pre-recognition than simply an unsecured LOC.

- However,, this type continues to be ‘revolving,’ which means the balance might be improved at your discernment and myself affects your debt solution ratios.

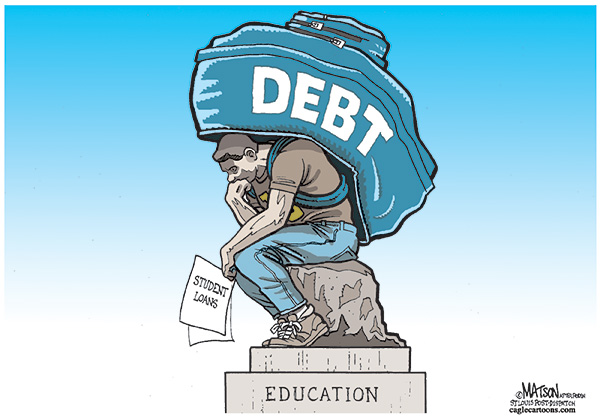

Figuratively speaking

Whole equilibrium. When you have pending otherwise effective student costs, loan providers calculate a portion of the entire harmony into your month-to-month loans stream. Most of the time, college loans bring lower interest and much more flexible repay times and you will try quicker ‘weighted’ as compared to, say, credit debt.

Spousal otherwise Youngster Service Money

Monthly-percentage count. Loan providers basis such payments into the financial obligation solution proportion when you are paying out. When you are finding these payments, a percentage was placed into the month-to-month income.

At some point, the way you control your financial obligation is reflected on the credit score, and you will physically influences your overall monthly debt provider (debt-to-income) ratios, all of and therefore lenders used to be considered you.

Long lasting personal debt you may have, getting practical together with your income and you will finances will help you keep upwards consistent repayments to own a healthier credit photo. Therefore the longer you can reveal a great reputation of using your debt, the easier and simpler it would be to get your popular lender, or a level ideal speed, on-board.

Exactly how loan providers dump the debt are going to be tricky. But i make it obvious.

Looking to purchase a home? All of our unbelievable True Northern Home loans helps you with all your debt questions – on your own prominent words – and certainly will quickly processes their pre-acceptance so you know exactly where you are and you may and this financial can be your better fit.

Weigh the debt having professionals who proper care.

Irrespective of the debt sizes, we are able to make it easier to types it out and acquire a knowledgeable technique for mortgage pre-recognition when you are buying your very first house, or if you have to key loan providers on revival or refinance for additional finance.