USDA Mortgage Apps 100% Home Buy

Central Palms Hotelseventh Peak Mortgage makes it easier so you can qualify for 100%, No cash Down USDA financing programs during the New jersey, Ny, Pennsylvania, Virginia, Maryland, Texas, Fl, Texas and you will Kansas!

USDA Rural Creativity mortgage loan money are specially made to help lower to help you average income houses and you will first time homebuyers get homes inside USDA qualified outlying portion. seventh Top Mortgage also provides USDA financing apps which can be used buying a preexisting household, create a new house off abrasion, otherwise make repairs otherwise renovations so you’re able to a current USDA eligible rural possessions. Such financing may also be used adjust drinking water and you will sewage options on the rural property, or even regularly move in a home altogether. USDA mortgage applications can be found in all the county seventh Level Home loan is authorized to complete financial credit plus Nj, Ny, Pennsylvania, Virginia, Maryland, Tx, Fl, Colorado and Kansas. General qualifications direction toward program are identical throughout the all of the state, but not for each and every condition considering earnings and you may inhabitants density. The good news is that in the event that you want a home mortgage away from 7th Top Mortgage in a single either New jersey, Nyc, Pennsylvania, Virginia, Maryland, Texas, Florida, Tx and you may Kansas really counties during these claims meet the requirements!

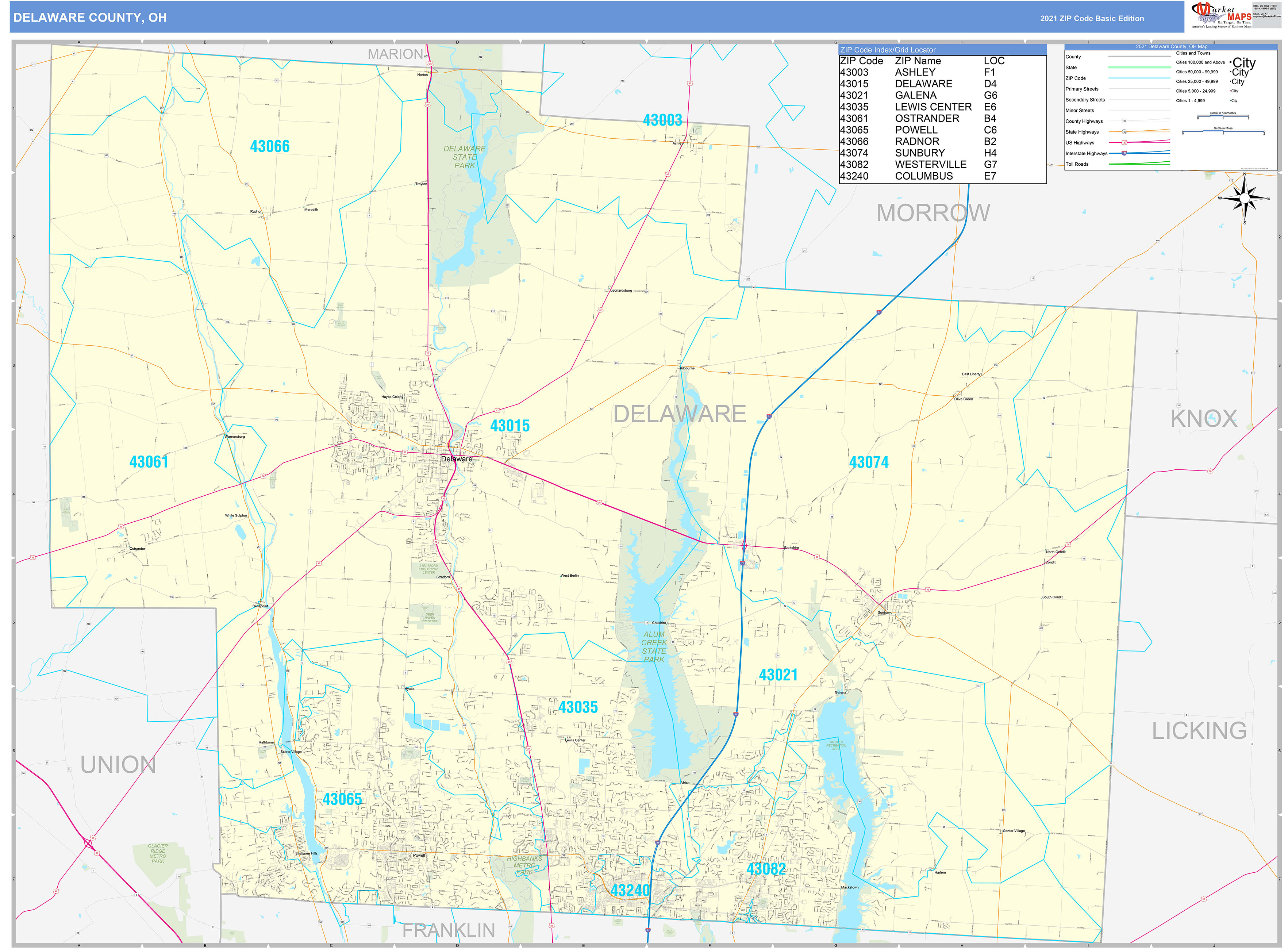

USDA Qualified Portion

Whenever you are interested in an effective USDA home, the next thing is to ascertain perhaps the house your own looking to buy is currently for the good USDA qualified area. USDA qualified portion are priced between state to state and so are calculated according to a number of things. To have a location are USDA eligible it ought to be discovered for the a rural area. The USDA talks of an outlying area as the people town that’s rural in the wild and that is perhaps not section of otherwise of this an urban area, otherwise one town, town or city and has now below 10,000 people. Other smaller outlying section outside big society locations having a good major insufficient mortgage credit get qualify having communities between 10,000-20,000 citizens. A few of these section may not even be outlying in nature, but have populations regarding lower than 20,000 and generally are maybe not associated with any major town otherwise cities.

USDA Money Limitations

Once the USDA rural mortgage brokers was designed just for reduced so you’re able to moderate income domiciles, there are specific income limitations in position manageable qualify. In order to qualify for an excellent USDA home loan, your general yearly domestic money ought not to go beyond 115% of your mediocre average money for this particular town. Based on where you’re deciding to purchase your family, earnings limitations is generally high otherwise down according to that particular area’s mediocre average earnings. Such, if you are deciding to purchase a beneficial USDA eligible assets within the The new Jersey the income restrict is in fact across the board place in the $91,500. Having a complete a number of USDA qualified counties, as well as their income constraints you can check out this link or get in touch with our financing agencies here at 7th Top Financial.

Because potential client has actually discovered a great USDA eligible property, the house or property need meet particular USDA mortgage conditions, overall these types of needs are the same for all government covered money. All features should be more compact in nature and see all the setup requirements imposed from the County and you may local governments.

In general, 7th Peak Home loan might help one debtor having fico scores out of 620 or better qualify for a beneficial USDA mortgage loan within the The Jersey, Nyc, Pennsylvania, Virginia, Maryland, Colorado, Florida, Colorado and Kansas. When you have a good credit score having small borrowing from the bank blips right here and truth be told there we might be able to get you qualified, all you need to do is actually get in touch with our reps or complete the contact form less than in order to find out.

USDA Loan Refinance Option

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

When you yourself have currently obtained a great deal to your a great USDA mortgage, you’re shocked to understand that you can get an even most readily useful offer to the an excellent USDA refinance loan. USDA refinance loans are just entitled to latest USDA money and are quick and easy without assets evaluation. There are a few additional re-finance loans readily available including streamline and you may low-improve re-finance finance, with many financing demanding no house appraisal although some permitting you to invest in your own settlement costs for the complete prominent of your own loan. And one of the greatest pieces regarding the USDA refinance money is actually that they make sure the new USDA loan can lead to an effective straight down month-to-month mortgage payment than you happen to be purchasing today.

Note: By the distribution the demand, you grant permission to have seventh Top Mortgage to get hold of your by the current email address or from the cellular phone loans Botsford CT.