This new Dos and you can Do nots of getting an exclusive Mortgage Pre-Acceptance

Central Palms HotelThe latest housing industry is surviving within the Ontario which have one another unmatched construction sales and you can grows on the average house rate on the GTA and you can someplace else regarding Province. Inspite of the lingering Covid-19 Pandemic, Ontario home owners was seeing a thriving real estate market.

With regards to the Ontario Real estate Relationship, domestic conversion activity stated from Multiple listing service (MLS) in Ontario designated thirteen, 885 gadgets into the January in the 12 months and that means a rise regarding 29.5% in comparison with household conversion process the same time a year ago. That it signifies yet another sales listing getting January in the Province. The common cost of resale domestic residential property bought in Ontario throughout the are accurate documentation $ 796,884 ascending 26.7% out-of .

To profit away from instance a bona-fide property upswing inside Ontario good mortgage pre-recognition can also be depict an excellent step into the being approved having a good mortgage. While shopping available for a home loan it may be advisable to go through the procedure for pre-acceptance to simply help promote a sense of exactly how much you could possibly manage and you can what sort of financial you will likely qualify to own.

Just what To not Would Just after Being Pre-Approved having a mortgage?

Though it is most beneficial to try and keeps an offer out of what you are able end up being pre-approved to have with respect to obtaining an interest rate, you’ll find points that never perform concerning the pre-acceptance procedure.

- Shortly after getting pre-recognized, dont get after that credit Just after taking wide variety you to reflect your financial predicament its very important to not incorporate any the fresh new potential expense. Applying for a charge card, including, can potentially enhance your debt obligations if you aren’t able to invest completely.

- Dont intend on budgeting within extremely high stop of your own budget- monetary situations can transform very support some wiggle place inside the your allowance when plugging regarding quantity.

- Prevent while making any larger requests- try not to throw one thing into the total budget that will alter the quantity for any sitting yourself down having a lender. New number is to stay a comparable.

- Dont make any alter toward job reputation stop stopping your existing standing otherwise applying to almost every other jobs you to definitely might have a good probationary months. The fresh amounts will be remain a similar and that includes salary data you given regarding the pre-approval procedure

Create pre-approvals hurt your credit rating?

It’s important to remember that a beneficial pre-approval is essentially a quotation with what you could potentially be considered having inside the a mortgage loan. A lender won’t be pulling the borrowing from the bank in pre-recognition process this is why, pre-acceptance doesn’t apply to your credit score. When it comes time to sit down with a loan provider and you will negotiate this new terms of an interest rate, the borrowing will be drawn off possibly Equifax or Transunion.

Just what any time you create before applying getting a mortgage?

- Know your credit rating and attempt to increase your credit rating just before seeking pre-acceptance.

- Assemble most of the documentation expected including proof money, financial support statements, and you can evidence of assets.

- Lookup a beneficial pre-acceptance cost.

- Be in contact that have an agent getting guidelines.

Do you really feel pre-approved for home financing and stay declined?

Brand new quick answer is yes. Home loan pre-acceptance lies in specific criteria. Minimum conditions are needed to be eligible for a mortgage out-of a lender otherwise credit union. These businesses will demand an excellent credit history, good enough showed money, and you can a reduced obligations ratio compared to current assets.

Private lenders are located in the right position, although not, in order to pre-agree homeowners having a secured real estate loan even after borrowing from the bank factors otherwise other sorts of salaries and additionally self-working earnings. Although there are going to be evidence of month-to-month salary and any extra possessions that will confirm of use, being refused a personal financing is more unlikely than other items of loan providers.

Should i pay off Credit card debt before applying getting an excellent mortgage?

Any type of financial obligation that requires constant monthly premiums are paid down as fast as possible. In so doing, youre reducing your complete home debt ratio which will increase the chances of being qualified to discover the best terms to possess a good real estate loan.

This is particularly true having credit debt. Of the many family personal debt, credit card debt might be paid basic. Not simply would handmade cards always feature extremely high-rates (particular notes fees as high as 19% so you’re able to 21% interest or higher such as the actual situation of some store credit cards) but credit card debt is crappy obligations about sight from every lenders.

If the credit card debt is at accounts considered too much because of the loan providers, this could end of several loan providers of pre-approving your getting a mortgage. Private loan providers might be able to pre-agree your getting a mortgage, not, in the event that almost every other standards are fulfilled.

Just what Financial Speed Must i Rating Pre-Acknowledged Having?

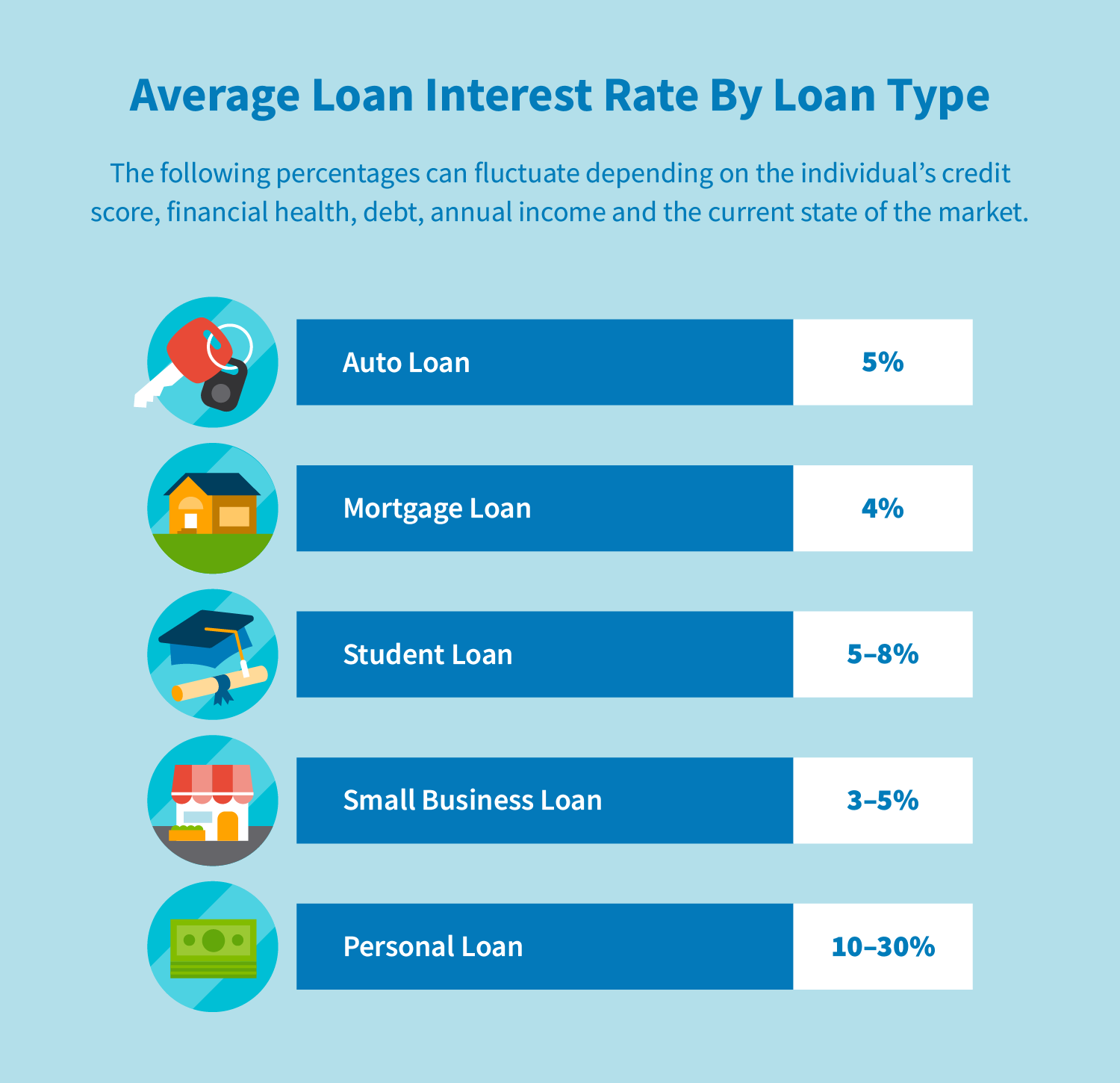

Home loan cost will vary with respect to the financial picture of for each candidate. The greater the funds, the lower the household debt, the higher the credit rating, therefore the probability of additional assets will guarantee the best rates toward a beneficial pre-acknowledged mortgage.

In contrast, damaged borrowing, issue to prove monthly paycheck, not enough assets to act as more guarantee would-be grounds to pre-approve having an interest rate with a high interest rate and you can higher full costs on the pre-acknowledged mortgage. Private loan providers can pre-agree to have like a loan.

Interest levels of this most individual mortgage loans are priced between eight% to twelve% with regards to the unique financial issues of your applicant payday loans Manitou Springs. Banks should be able to discuss all the way down rates into pre-acknowledged mortgage loans. New requirements, although not, are very stringent, and you may busted borrowing from the bank have a tendency to end a lender regarding pre-granting an applicant.

Individual loan providers can pre-accept individuals with broken credit and you will low-old-fashioned earnings when these types of applicants may have been refused pre-approval by a lender.

Simple tips to Apply for Individual Home loan Pre-Approval which have Mortgage broker Shop

At the Large financial company Store we will be in a position to permit you the Automatic Personal Mortgage Pre-Recognition Device. So it device will allow you to determine what kind of finance you can even be eligible for which will take the latest curious from the loan approval techniques. Just after completing the application, a good PDF structure of the pre-acceptance document is obtainable and that is emailed to you personally to have your reference.

There are many version of mortgages that exist using well-based personal lenders. Whether your pre-acceptance tool implies that you have not been approved, we could sit with you and attempt to negotiate terminology to the a private mortgage loan considering your whole financial visualize. Don’t hesitate to contact us at your convenience. We will be able to make it easier to negotiate financial money in order to allow you to get closer to your financial needs.