Powerful investigation and you may analysis on the virtually every digital situation

Central Palms HotelRequire alot more

- Alt lenders’ capability to leverage tech and offer more efficient financing services towards the underserved are permitting them to penetrate the market industry and get achievement.

- Insider Cleverness has actually broken down exactly what alternative financing is, listing the major alt lenders in the industry, and you may outline exactly how solution loan providers is threatening new popularity out-of incumbent banking institutions.

- Might you work with the fresh new Financial world? Rating organization facts to your newest technology designs, sector manner, along with your opposition which have investigation-driven search.

Nonbanks and you can choice lending institutions make their way to your financial globe posing a major possibilities in order to incumbent financial institutions. Alt lenders’ capability to use tech and provide successful and you may productive credit features to help you underserved people and other people is actually letting them penetrate the market and find achievement.

Lower than we fall apart just what choice financing is, record the big alt lenders in the industry, and you can outline exactly how alternative loan providers was intimidating new dominance out-of incumbent banks.

Nonbank real estate loan

Due to the regulation off mortgages, it could be difficult for incumbents in order to digitize new financing procedure, and incapacity off traditional banking institutions to help you adapt to the brand new digital landscaping enjoys produce an increase in alt loan providers promoting home loan fund to help you users.

Insider Intelligence’s On the web Financial Financing Statement learned that the major five You banking institutions Wells Fargo, Bank regarding The united states, and you will JPMorgan Pursue, All of us Bancorp, and you can Citigroup just taken into account 21% of full financial originations, that’s a giant .

Alt loan providers are a threat to help you incumbents as they possibly can bring old-fashioned financial products, such as for example mortgages, to help you users cheaper with informal eligibility standards. This in conjunction with their technical choices allows alt lenders to include mortgages into the a attractive ways.

Home business alternative loan

Applications out of microbusinesses and you will small enterprises are generally refuted by the antique creditors. As a result of the loose statutes to possess alt lenders, they could benefit from the latest sought after regarding small businesses.

Centered on a survey about Federal Reserve Bank from Richmond, in the 2016 merely 58% off loan applications from small businesses was indeed passed by incumbent finance companies, compared to 71% approved by alt lenders that same year.

As opposed to traditional lending, alt lenders manage to influence an over-all set of investigation and server reading – letting them started to next on the small business financing sector than just incumbent finance companies.

Peer-to-Fellow (P2P) loan

Peer-to-Fellow money one of the most well-known types of option financing assemble a debtor, an investor, and a partner financial owing to an online system. Leverage metrics, such credit scores and you will social networking pastime, P2P systems can hook up borrowers so https://paydayloancolorado.net/applewood/ you can loan providers in the compatible interest rates.

P2P credit platforms support interactions instead in reality owning brand new finance allowing them to continue will cost you reasonable. This top quality is particularly appealing to users trying re-finance established obligations in the low rates you are able to.

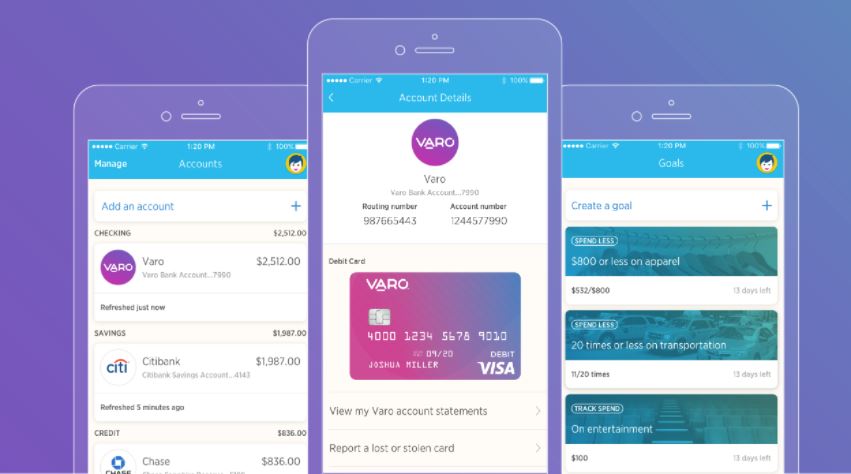

Top nonbank and option lenders

- SoFi: Which business very first concerned about student loan refinancing, however, has grown to provide home loan refinancing, mortgages, and private finance. Inside the 2019 SoFi signed an effective $five hundred billion resource round provided from the Qatar Resource Authority – posing a danger to incumbent finance companies.

- Quicken Funds: Which based nonbank is known for its Rocket Financial, an online home loan software which takes less than ten full minutes in order to done. In Q4 2017, Quicken Financing turned into the biggest All of us residential financial maker because of the volume – also conquering away Wells Fargo.

- Kabbage: It was one of the primary online credit platforms and you will spends third-team data to end SMBs distribution wrong guidance. The newest business has the benefit of team-to-company operations, and in they covered $200 billion rotating credit studio immediately following already searching an excellent $700 million securitization agreement 3 months past.

- OnDeck: This can be an event-let global financial platform helping small- and average-measurements of companies secure prompt, short term business loans to $250,000 and you may personal lines of credit around $100,000. For the , OnDeck try received because of the Enova to improve use of their monetary services and products for both business owners and people.

Choice financing business

Even though conventional finance companies nevertheless keep the largest share of the market to possess team lending, gains keeps proceeded to sluggish recommending a heightened need for alt credit networks. Courtesy tech using AI and servers reading, alt loan providers can effectively on-board people.

Centered on Insider Intelligence’s SMB Financing Declaration, SMBs compensate a lot of private industry enterprises regarding the You and employ sixty% of all of the gurus in the united states. not, SMBs will often have difficulties whenever trying to get funds within incumbent financial institutions and you will instead consider solution lending networks.

Due to the massive SMB markets proportions, choice credit businesses are organized so you can jeopardize in order to incumbent banking institutions, and you will unless conventional banking institutions revise its lending methods, alt lending technology could potentially overhaul heritage processes and you can acquire a good higher percent of total business.