National Shield requirements getting Virtual assistant financing eligibility

Central Palms HotelWhile the a thanks for their service, the fresh Va claims mortgage brokers called Va fund. This will be generally the greatest home loan system offered, compliment of its lowest pricing additionally the solution to purchase instead of an advance payment.

Yet not, not everyone who may have supported the government is eligible getting Va money. You’ll find rigid stipulations, in addition they alter based on how different people served.

Specific home buyers have no idea it, but some Federal Shield and you may Set aside players qualify for Virtual assistant finance. Naturally, this is based mostly about precisely how long it supported, otherwise just what the provider entailed.

Many members of new National Protect usually acquire Va eligibility by with at the least half a dozen years of service in the Chose Reserve and another of the following the:

- Respectable discharge

- Put-on brand internet new retired checklist

- Gone to live in Standby otherwise Ready Set-aside, as well as have an enthusiastic respectable reputation

These types of aren’t the only ways in which Federal Guard people normally secure Virtual assistant loan qualification, even though. As well as the prior criteria, Servicemembers and Veterans are going to be eligible if they meet one of the second conditions:

- Persisted so you’re able to suffice throughout the Selected Set-aside for more than half dozen ages

- Providing for around 90 days toward active obligation during wartime

- Becoming released otherwise create for a handicap associated with solution

One thing to note is that active responsibility should be during the wartime. When the a nationwide Protect user is active getting Condition Energetic Responsibility, this time around will not matter towards the the active responsibility requirement. Although not, Federal Shield professionals can invariably rating even more advantages setting the official, with respect to the claim to suffice in.

There are also unique circumstances, many of which usually do not necessarily belong to this type of requirements. For those who have questions regarding the possible eligibility, discover an entire selection of stipulations right here.

To buy property with an effective Virtual assistant mortgage

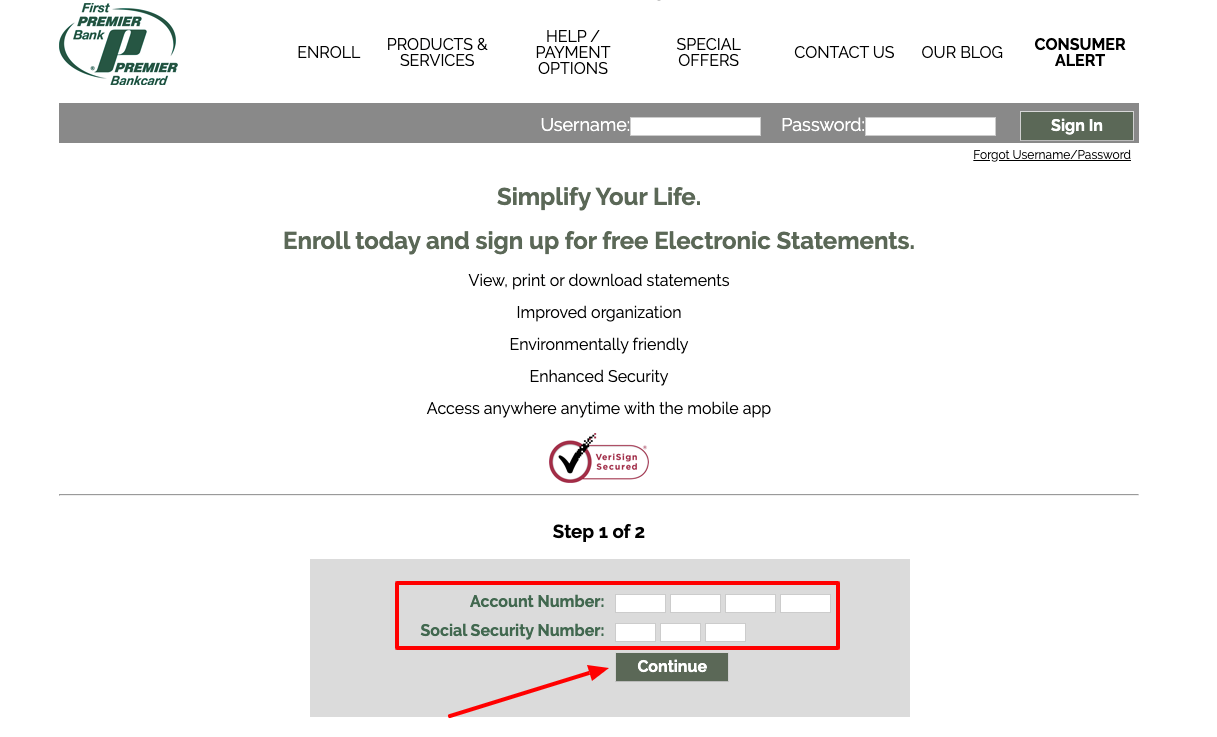

If you have met those standards, you then will be eligible to get Virtual assistant degree. Most of the users must get Va certification before he is qualified to receive an effective Va loan, no matter what their provider entailed.

You can purchase the fresh new Certification out-of Qualifications from the You Department regarding Experts Activities right here. There are even extra fine print you to definitely National Protect or Set aside players need to pursue being specialized. These are simply to ensure that you meet the requirements, therefore see all standards, this step really should not be difficulty. People are laid out into the VA’s webpages.

Shortly after having your Certification away from Eligibility, it is possible to pick a house having fun with a Virtual assistant mortgage. There are plenty of advantages to the latest Va loan, along with certain specific to particular servicemembers.

You to extra benefit one Federal Guard and you will Set aside members get was that they may range from the income they rating means their services within their income towards mortgage degree. That is helpful in decreasing the financial obligation-to-earnings ratio, and it can end in a level lower financial price.

Begin your house to invest in techniques

After you have end up being certified, you could start the process of to invest in property. Virtual assistant users will get a Va financing owing to any organization one offers them; not, of numerous players find educated loan providers are the quickest and best option for to invest in a home.

The best way to find the appropriate bank to suit your certain situation should be to affect several lenders and you may communicate with all of them about precisely how capable help you.

- Are you Eligible?

- DD214

- Certification off Eligibility

Excite contact the assistance when you’re doubtful of every fraudulent circumstances otherwise have issues. If you would like to track down considerably more details regarding the positives, kindly visit the official All of us Bodies site for the Department off Seasoned Factors or even the You Institution from Homes and you can Metropolitan Creativity.

MilitaryVALoan is actually possessed and you can work by Complete Beaker, Inc. NMLS #1019791. View here to see all of our home loan permits towards NMLS Consumer Access website.

Complete Beaker, Inc. is not authorized and work out domestic mortgage loans when you look at the Nyc Condition. Mortgages is set up with third-party organization. When you look at the New york County its licensed from the Agency of Economic Qualities. Excite click the link unless you would you like to us to promote your suggestions.